We want to remind you about the new regulation on cross-border or international payments to and from South Africa and other CMA (Common Monetary Area - Namibia, South Africa, Lesotho, and Eswatini) countries, effective Tuesday, 10 September 2024.

The new regulation will impact payments to South Africa in the following way:

Payments to South Africa and other CMA countries will be processed via SWIFT, and where applicable, customers will be prompted to update their beneficiary details via Internet Banking.

Updating beneficiary details might include, for example, full beneficiary address and reason for payment.

CMA payments will be subject to the below cut-off times:

Processing days Cut-off time

Weekdays 14:00

There will be NO processing done on Saturdays/Sundays and Public Holidays.

CMA payments will attract the following fees:

Inward Payments (N$4,999,999.99) N$25.00 VAT Inclusive

Outward Payments (N$4,999,999.99) N$20.00 VAT Inclusive

NB: These are Bank Windhoek charges, and the beneficiary Banks may impose additional charges.

The pricing and processing times of transactions will be affected, and clients can expect longer turnaround times. Transactions may take up to two business days or more to reflect on the beneficiary account.

Additionally, please take note of the transaction limit between domestic Electronic Fund Transfer payments (N$5,000,000.00) and CMA cross-border payments (N$4,999,999.99).

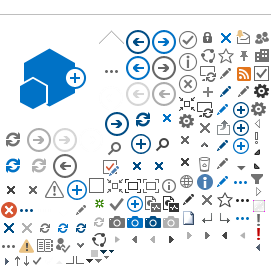

How to initiate a payment:

NOTE: Balance of Payments reporting (BOP) is a reporting system used to report all inward and outward cross-border payments to the regulator, Bank of Namibia. You might be prompted to update your current beneficiary details.

Payments from South Africa or other CMA countries:

Clients receiving funds via SWIFT from a CMA country must declare the funds before release. Depending on the reason for payment, clients may be required to complete a Balance of Payments form.

Debit Orders:

Effective Tuesday, 10 September 2024, South African Collectors / Entities will no longer be able to collect debit orders from their customers who have a Namibian account, nor will Namibian Collectors / Entities be able to collect debit orders from South African accounts.

Collectors/Entities should advise their clients/debtors to honour their commitments by initiating credit payments on their end to them.

Alternatively, collectors can register as collectors in different countries, subject to domestic debit order collection rules and regulations.

For further information, please contact our Customer Service Centre at +264 (0) 61 299 1200.